I noticed two attempts on the recent all time high of around $41,450, but both were lower attempts. As I went to sleep, it looked probable that we would see a new all time high. I’ve been seeing this symmetrical/ascending triangle that is signaling a move coming. This morning I awoke to see this wasn’t the case. In fact, price was now under $40k and it just stayed there for a couple of hours. I told my wife I thought a crash was imminent.

And we are seeing this play out right now in real time. The height of the excitement was about an hour and ten minutes ago. A very sharp couple of red candles moved the price down to what I believed would be the next support level: $37.2k. We bounced right at this level as the support held. The bounce moved rapidly back up to $38,850 in twenty minutes or so. Currently I’m seeing $37,950-$38,150 over the timeframe I wrote this during.

What’s next? I think that was the low. The rapidity at which the dip was bought and the strength of the bounce off of that $37,200 support jives with what we’ve seen on all these recent flash crashes since the pre-parabolic/early-parabolic run (Sep 2020 – Jan 2021). The lows are bought up fast and the worst-case scenarios from a TA perspective never seem to materialize yet.

If this new recent low holds in the next 24 hours, it will be a bullish signal for me. After that, if we quickly return and sit above $40k (which I think is likely in the next 48-72 hours given the precondition I just specified), the parabolic move up will come again taking us to the $44-45k range quite quickly thereafter (perhaps 3-5 days from now).

I do not have good evidence that is quantitative to support these intuitions that are based on market experience and mental math. This is never investing advice, just my thoughts and opinions.

Here are powerful things I’ve found this morning that are leading me to these educated feelings:

From the Altcoin Daily YouTube Channel:

Anthony Pompliano Explains How 1 Bitcoin Could Be Worth 1 Million Per Coin!!! Cryptocurrency News

Orange Pill [OP23] – Bitcoin Reveals the Fiat Dark Ages

UPDATE: “dip” went much lower bottoming around $34,400 in a flash crash. It’s likely many leveraged long positions were liquidated in the crash. Quickly rebounded back to $38,211 with massive price swings and a return to volatility. To me, the growth trajectory we are currently on seems to be parabolic similarly to the run from Nov. 12th, 2017 ($5,886) through 19 days later (12/1/2017) with growth of 84% sitting at $10,869.

This move was similar if we look at last bottom being Dec. 21st ($22,729 about if I recall?) through the high (last night?) at $41,985. The growth was 78.9%….comparable. However, in 2017, there was not a 19% crash at that moment. Soon the price would nearly double again.

Therefore, perhaps after this correction (if that was the bottom), we will nearly double from the $34,400 bottom up to the mid $60,000’s perhaps somewhere? Max Keiser seems to think so and this would occur in about 19 more days or so if we follow that trajectory – meaning January 29th (end of January).

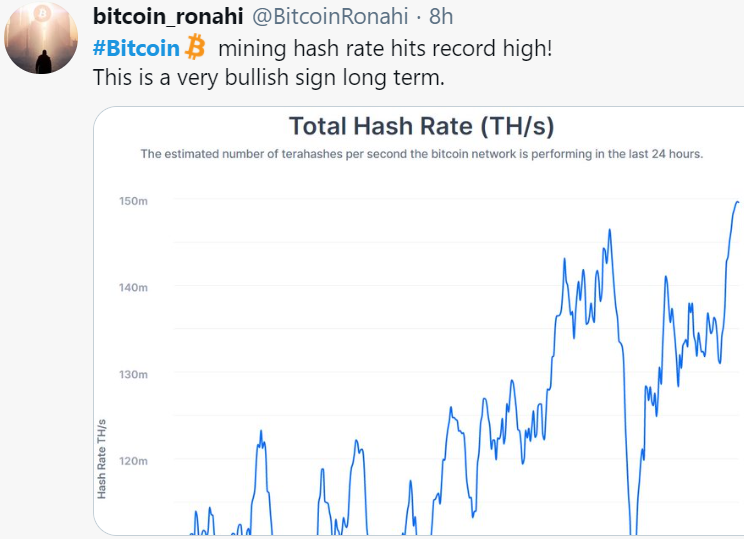

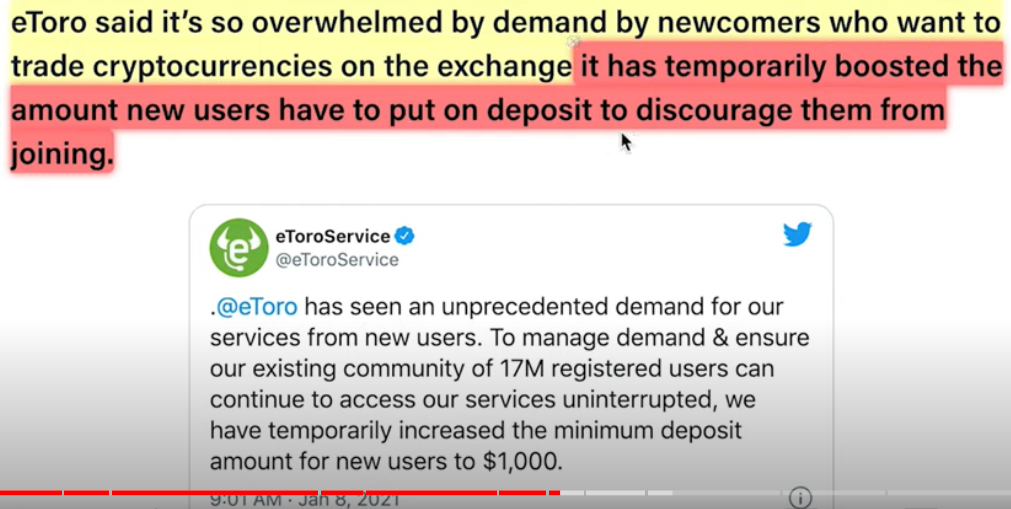

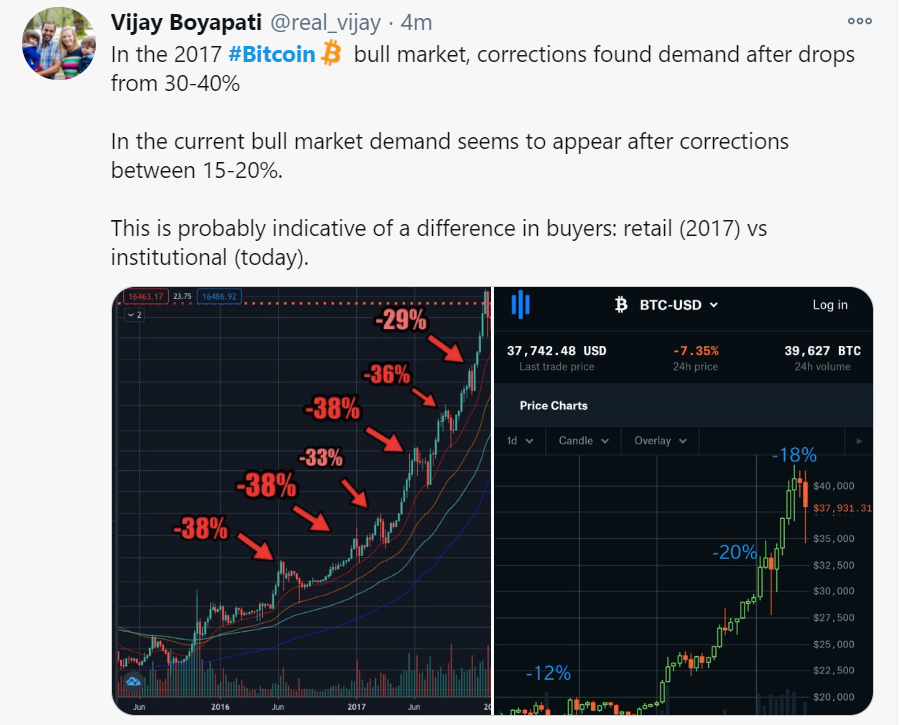

The question is, with strong hands (i.e. institutions) holding right now, we see crashes of magnitude 19% at worst so far during these past couple of months. At this same point in the bull cycle of 2017, we had experienced two drops that were both 37 and 35 percent respectively during mid-2017.

Therefore, if the growth curve (i.e. time derivative or rate of change w/ respect to price) looks like late 2017, but the crashes are only 2/3 as bad…..does that mean this crash will only be 2/3 as bad in terms of percentage magnitude? (I think such a crash will cause this macro BTC outlook to look like 2012-2013 w/ two bull cycles and a long pause in the middle.)

It’s rational to assume we might only crash to $40k or $35k lows as we slowly rebuild back to the $60-$70k level after several months. Then coming into September and October, we see parabolic moves again peaking at $1M per coin in late 2021 or early 2022.

If there is a similar gigantic crash at all….different players, different game. My money’s on the ultra wealthy protecting this new playground more and more.

Leave a Reply

You must be logged in to post a comment.